Navigating the Maze of Business Loans Made Easy

Simplify your journey through the maze of business loans with our expert strategies.

Setting the Stage: The Importance of Business Loans

In the grand theater of entrepreneurship, business loans are the foundation that supports the set where dreams and reality converge. They provide the financial backbone for growth, expansion, and sometimes, survival. But why are they so pivotal? Simply put, they furnish businesses with the capital necessary to breathe life into innovative ideas, acquire essential assets, and scale operations beyond the confines of initial capital limitations.

Overview: What Makes Navigating Business Loans a Maze?

Embarking on the quest for a business loan is comparable to navigating a maze, packed with plenty of choices, each with its unique set of rules and requirements. The complexity arises not just from the variety of loan types available but also from the differences of interest rates, repayment terms, and eligibility criteria. This maze, scary as it may seem, is doable with the right knowledge and preparation.

Types of Business Loans

Understanding Business Loans

The Basics of Business Loans: Types and Terms

Business loans, in their essence, are financial agreements between a borrower and a lender. The spectrum ranges from term loans, lines of credit, to merchant cash advances, each serving different business needs. Terms can vary dramatically, from short-term loans payable within a year, to long-term loans that can extend over decades.

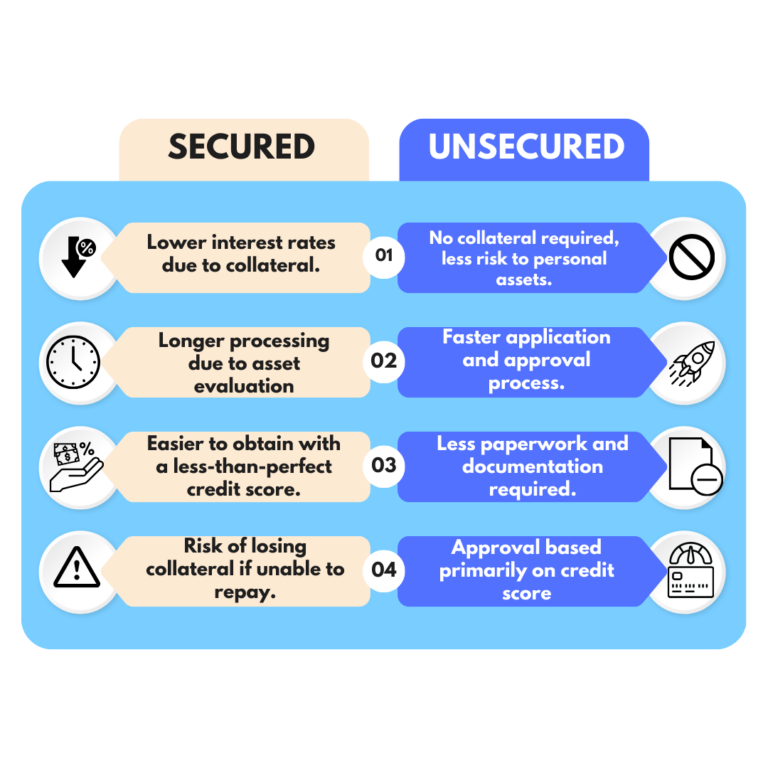

Secured vs. Unsecured Loans: Choosing the Right Path

At the crossroads of business financing, entrepreneurs face the decision between secured and unsecured loans. Secured loans require collateral, offering lower interest rates, while unsecured loans, without the need for collateral, carry higher risk for the lender and hence, higher interest rates.

Interest Rates Demystified: Finding Favorable Terms

Interest rates are the compass by which the cost of borrowing is gauged. Understanding how rates are determined—considering factors like market conditions, credit risk, and loan duration—is crucial for finding the most favorable terms.

Preparing for the Journey

Assessing Your Financial Health: The Starting Point

Before setting foot in the maze, assessing your financial health is very important. This involves reviewing cash flow, debts, and assets to ensure your business can bear the additional burden of a loan.

Business Plan: Your Map Through the Maze

A well-crafted business plan is your map through the maze, showing lenders your destination and how you plan to get there. It outlines your business model, revenue projections, and how the loan will be utilized to achieve growth.

Interest Rates Demystified: Finding Favorable Terms

Interest rates are the compass by which the cost of borrowing is gauged. Understanding how rates are determined—considering factors like market conditions, credit risk, and loan duration—is crucial for finding the most favorable terms.

Preparing for the Journey

Assessing Your Financial Health: The Starting Point

Before setting foot in the maze, assessing your financial health is very important. This involves reviewing cash flow, debts, and assets to ensure your business can bear the additional burden of a loan.

Business Plan: Your Map Through the Maze

A well-crafted business plan is your map through the maze, showing lenders your destination and how you plan to get there. It outlines your business model, revenue projections, and how the loan will be utilized to achieve growth.

The Role of Credit Scores in Securing Loans

Credit scores serve as the beacon, guiding lenders in assessing your creditworthiness. A robust credit score not only opens doors to better loan options but also more favorable interest rates. Lenders use this score to assess the risk associated with lending money, determining not only eligibility but also the terms of the loan, including interest rates and repayment schedules

Term Loans: The Classic Route

The classic route through the maze, traditional bank loans offer stability and substantial funding. However, navigating this path requires a strong credit history and solid business plan.

SBA Loans: A Guided Path for Small Businesses

SBA loans, backed by the Small Business Administration, offer a guided path for small businesses, providing lower interest rates and longer repayment terms, although with stricter eligibility requirements.

Business Lines of Credit: Something to Keep in Your Backpocket

Unlike a term loan, a line of credit offers businesses access to a pool of funds to draw from as needed. Interest is only paid on the amount drawn, making it a flexible option for managing cash flow.

Equipment Financing: Like a Auto Loan But for Equipment

This type of loan is specifically for purchasing business equipment. The equipment itself often serves as collateral for the loan, which can cover up to 100% of the equipment’s cost.

Merchant Cash Advances (MCAs): Fast and Easy Money

MCAs provide businesses with a lump sum of cash in exchange for a portion of their future sales. They are quick to obtain but can have higher costs than other types of loans.

Alternative Lending: Shortcuts Through the Maze

Alternative lending offers shortcuts through the maze with more flexible eligibility criteria and faster approval times. This route includes online lenders, peer-to-peer lending, and crowdfunding.

Microloans: Small Steps to Big Success

Microloans represent small steps that can lead to big success, especially for startups or businesses with minimal capital requirements. They offer smaller amounts, but with less strict approval criteria.

The Application Process

Gathering Your Documents: Packing for the Journey

Gathering necessary documents is like packing for the journey—essential for moving forward. This includes financial statements, tax returns, business plans, and more.

Documents needed for Business Loan with Traditional bank

Business Plan

Personal and Business Tax Returns

Personal and Business Bank Statements

Financial Statements

Business Legal Documents

Proof of Collateral

Owner’s Personal Information

Credit Score

Accounts Receivable and Payable Aging

Business and/or Personal Resume

Insurance Information

Business Forecast

Debt Schedule

Documents needed for Business Loan with Private lending

Completed loan application form.

Business bank statements (last 3-6 months).

Proof of collateral (if applicable).

Personal identification (e.g., driver’s license or passport).

Credit score or authorization to check credit.

Accounts Receivable and Payable Aging reports (mainly for working capital loans).

A list of current business debts, including terms and repayment schedules.

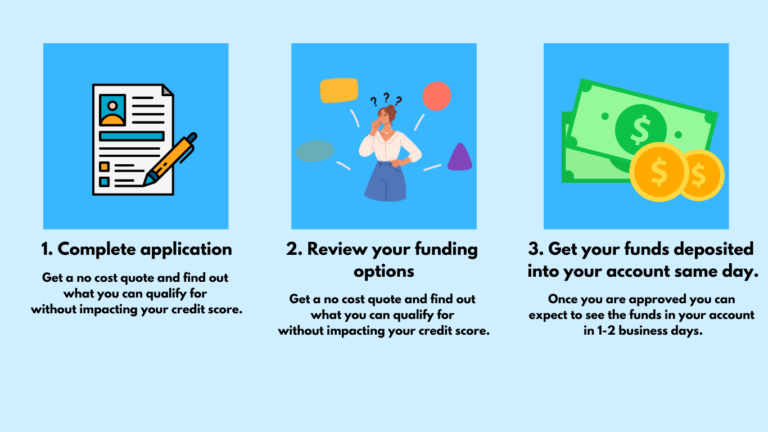

Navigating the Application: Tips and Tricks

Navigating the application process requires diligence and attention to detail. Tips include thoroughly understanding the requirements, preparing a strong business case, and ensuring all documentation is complete and accurate.

Understanding Lender Requirements: Insider Knowledge

Insider knowledge of lender requirements can significantly clarify the application process. Each lender has its unique set of criteria, understanding which can tailor your application to better meet these requirements.

Challenges Along the Way

Common Pitfalls and How to Avoid Them

The journey is full of pitfalls, from underestimating the amount needed to overlooking hidden fees. Awareness and preparation are key to avoiding these common errors.

Dealing with Rejection: Not All Who Wander Are Lost

Rejection is not the end but a detour. It offers an opportunity to reassess, refine your business plan, and explore other avenues.